| 1 | Sidra Coin Launching |

| 2 | The BlockChain |

| 3 | Platform |

| 4 | Loyalty system |

| 5 | Learning Environment |

| 6 | Innovation center |

| 7 | Foreign Exchange |

| 8 | Crowd funding |

| 9 | Incubation |

| 10 | Acceleration |

| 11 | funding |

| 12 | Digital Identity KYC |

| 13 | Customer Service Chatbot |

| 14 | Stocks Markets |

| 15 | Auction House |

| 16 | Freelancing |

| 17 | Layer 2 Dapps |

| 18 | Payment Gateway |

| 19 | Peer2Peer |

| 20 | Lending Platforms |

| 21 | Insurance Services |

| 22 | Hsalh |

| 23 | Robo Advisory |

| 24 | AI Trading as a service |

| 25 | Fraud Detection |

| 26 | Online Market Place |

| 27 | Multi Asset Allocation |

| 28 | RegTech KYC-AML |

| 29 | Installments as a service |

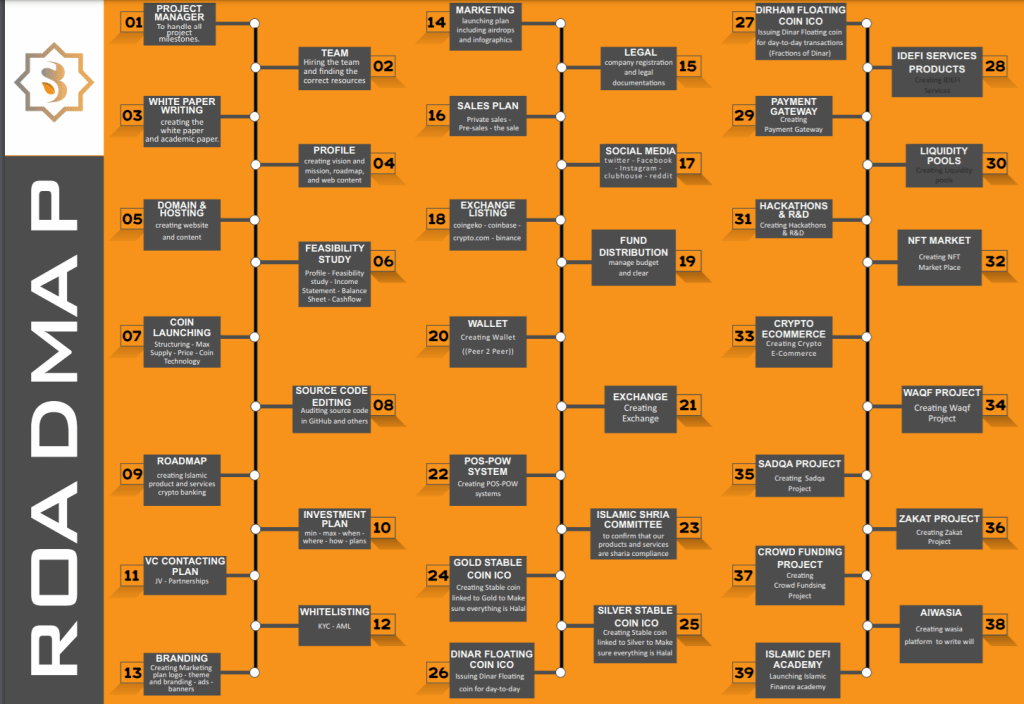

- Launching of Sidra Coin: The initial release of Sidra Coin, the cryptocurrency that the platform will be built around. This will be the first step in creating a decentralized and compliant digital currency for the Islamic market.

- Development of Blockchain technology: Building the underlying technology that will support the platform, including the creation of a secure and transparent blockchain.

- Creation of a user-friendly platform: Developing a platform that is easy to use and navigate, with a focus on user experience.

- Implementation of a loyalty system: Creating a rewards program that incentivizes users to engage with the platform and promote the growth of the network.

- Establishment of a learning environment for users: Providing educational resources and training opportunities for users to learn about cryptocurrency, blockchain, and Islamic finance.

- Setting up an innovation center for research and development: Creating a dedicated space for research and development to explore new ideas and technologies that can be integrated into the platform.

- Introduction of foreign exchange services: Allowing users to buy and sell different currencies, including fiat and digital currencies.

- Implementation of crowdfunding options: Allow users to invest in or support projects and businesses on the platform through crowdfunding.

- Incubation of new projects and businesses: Providing support and resources for new projects and businesses to help them grow and succeed.

- Provision of acceleration services for startups: Offering services such as mentoring, networking, and funding to help startups scale and grow.

- Establishment of funding opportunities for new ventures: Creating opportunities for users to access funding for their projects and businesses.

- Implementation of Digital Identity and Know Your Customer (KYC) procedures: Implementing strict KYC and AML procedures to ensure the legitimacy of transactions on the platform.

- Development of a customer service chatbot for 24/7 assistance: Providing 24/7 customer support via a chatbot to assist users with any questions or issues they may have.

- Introduction of stock market trading options: Allowing users to trade stocks on the platform.

- Creation of an auction house for buying and selling assets: Providing a platform for buying and selling assets, such as real estate, art, and collectibles.

- Integration of freelancing opportunities: Allowing users to connect with freelancers and outsource work on the platform.

- Development of Layer 2 Dapps: Building decentralized applications (Dapps) on top of the Sidra blockchain.

- Implementation of a Payment Gateway: Adding a feature that allows users to make and receive payments on the platform.

- Introduction of peer-to-peer transaction options: Allowing users to make direct transactions with each other, without the need for a centralized intermediary.

- Development of lending platforms: Creating platforms where users can lend or borrow money on the platform.

- Provision of insurance services: Offering insurance services to users, such as health, property, and casualty insurance.

- Compliance with halal investment principles: Ensuring that the platform adheres to Islamic finance principles, such as avoiding interest-based transactions.

- Introduction of robo-advisory services: Offering automated investment advice to users.

- Development of AI trading as a service: Creating an AI trading feature that users can access to help them make investment decisions.

- Implementation of fraud detection systems: Incorporating technology to detect and prevent fraudulent activities on the platform.

- Creation of an online marketplace: Building an online marketplace where users can buy and sell goods and services.

- Development

- of multi-asset allocation options: Allowing users to diversify their investments across different assets, such as stocks, real estate, and commodities.

- Compliance with RegTech KYC-AML regulations: Implementing regulatory technology solutions to ensure compliance with KYC and AML regulations.

- Introduction of installment payment options: Adding a feature that allows users to make payments in installments, rather than in one lump sum.

- These milestones are designed to provide a comprehensive and compliant digital currency platform that will meet the needs of the Islamic market. The Roadmap will be closely followed but is subject to change based on market conditions and the needs of the project.